It’s no secret that when interest rates begin to dip lower, there will be another wave of homebuying, which will drive the price of homes up even higher. It’s historically proven.

That’s why if you qualify for a home it is wise to buy now and build equity as rates are likely to come down and home prices are likely to increase. You can fix your price for a 2024 move-in and close escrow when rates drop. Take advantage of locking your interest rate today for extra insurance and if rates improve, your rate will be able to float down prior to closing.

No matter which way the real estate market is leaning, buying now means you can start building equity immediately and gain tax advantages for owning verses renting. “Remember, you marry the house and date the rate,” states Melissa Cohn, Regional Vice President of William Raveis Mortgage, “you can always refinance later.”

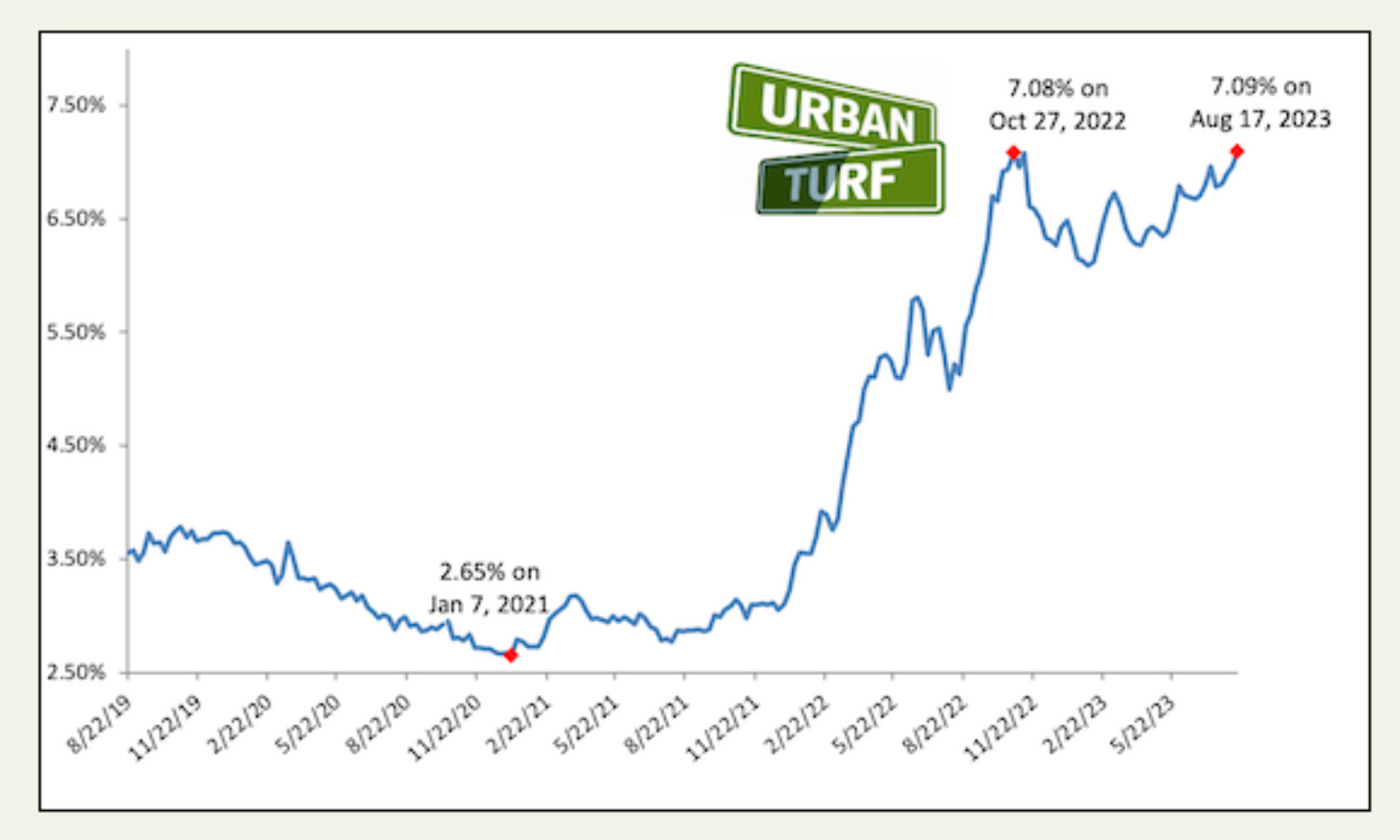

Long-term interest rates are at their highest level in decades, but the Mortgage Bankers Association (MBA) recently published its forecast for where it sees rates heading in the next two years.

The MBA forecasts long term interest rates to average:

6.2% Q4 2023

5.0% Q4 2024

4.6% Q4 2025

In general, if you can answer yes to these three questions, NOW is the time to buy.

1. Have you saved enough for a down payment? If you’ve been paying bills and saving, you may have a chunk of change for a down payment. Remember, even family members can help with some of the down payment and the more you put down, the less you’ll have to borrow (and so the less interest you’ll have to pay). Lenders approve loans if you have at least two months’ additional cash reserves; this provides a cushion if something unexpected happens.

2. Are you planning to keep the home for a while? Owning your home for a few years helps amortize the closing costs that are normal fees incurred at purchase. To justify those one-time transaction costs, it’s better financially not to sell too soon after buying. Capital gains taxes consume a larger portion of sales revenue when a sale is made within the first two years after the purchase.

3. Do you have good credit? Start by getting a credit check and pre-approval from a qualified lender early in the process because then you will know what price range you can qualify for. Many times, the best rates on mortgages are available to those that have demonstrated a history of on-time payments. Click here to get started.

(Information provided by Bankrate, Oct 15, 2023)

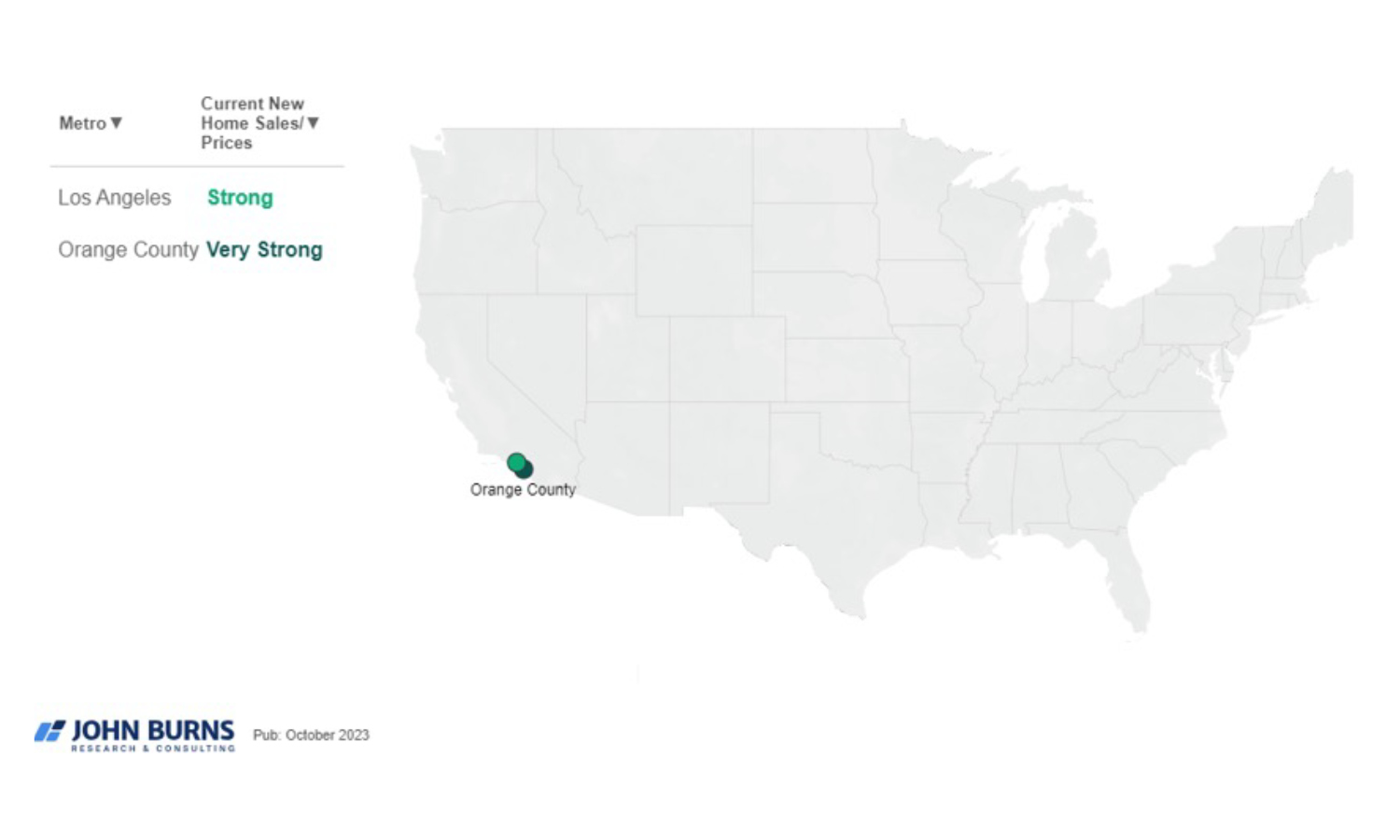

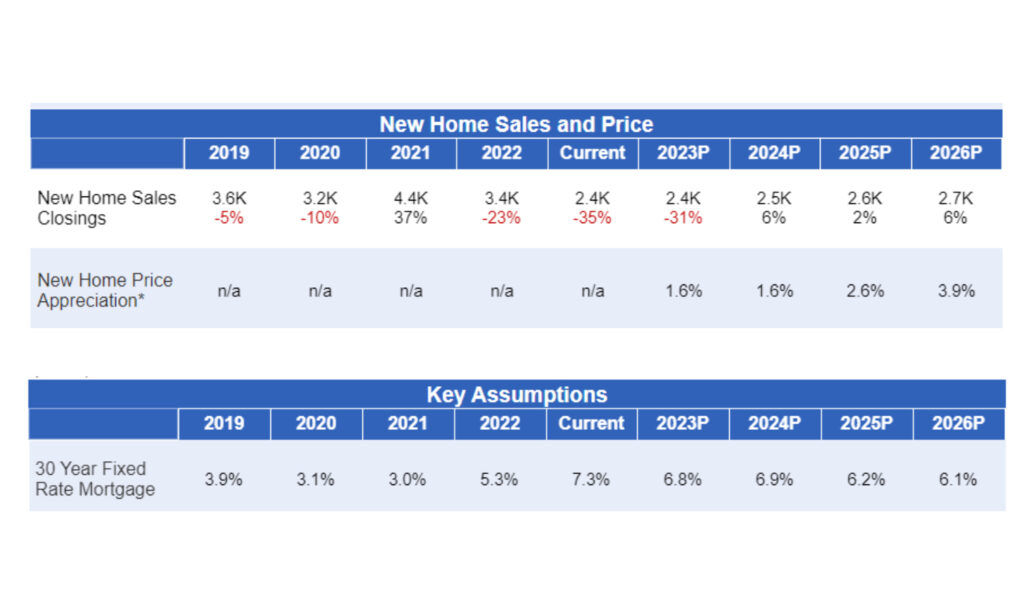

Deciding whether to buy a house now or wait depends a lot on where you want to call home. Regardless of national headlines, real estate is hyper-localized and varies significantly from market to market, even within the same state.

Most major housing markets continue to cool with the return of seasonality this year. However, they have remained strong due to the shortage of supply, demand for new homes, and attractive interest rate programs that are made available through select builders. Additionally, labor markets in most metros are holding up well even as the Fed has aggressively increased the interest rate over the past eighteen months.

Register to join the Docente email list and you’ll be among the first to know about any neighborhood updates.

*By providing your contact information you consent to receive periodic emails, phone calls, text messages and other communication from Intracorp and its subsidiaries. For mobile phones, standard text message and data charges may apply. Your consent is not a condition to purchase. At any time you may reply STOP to any communication from us to unsubscribe.

Explore Docente model homes anytime, anywhere with a virtual tour.

Schedule an appointment with our sales team to learn more about Docente.

The sales team will be available daily from 10am – 6pm, & Wednesdays 1pm-6pm

Call or text (949)287-2220

Get pre-approved for a home loan with one of our preferred lenders for competitive rates, a quick pre-qualification process, and a seamless home buying experience.

LoanDepot

Judy Downey-Fortson

Loan Consultant – NMLS: 457883

US Bank

Erica DeFoe

Mortgage Loan Officer – NMLS: 1274085

Copyright © 2022 Docente, Intracorp Homes.

All rights reserved.

Disclaimer: In our continuing effort to improve the design and function of the home through the development process, Claremont 96 Development LLC reserves the right to modify locations, homes, plans, phasing, improvements, materials, finishes, colors, landscaping and amenities without prior notice or obligation. All square footage(s) are approximate. Prices and availability are subject to change without notice. Ownership at Docente features automatic membership in the community homeowner(s) association with monthly dues which provide for private streets and common area landscaping maintenance. Claremont 96 Development LLC is a member of the Intracorp family of companies. Every Intracorp community is developed, built, sold and warranted by a separate legal entity. Sales brokerage services provided by Strategic Sales and Marketing Group, Inc. DRE# 01862116. ![]()